1 – “You shouldn’t buy life insurance for your grandchildren.”

Actually, it’s a smart idea and you should! Some people may believe that buying life insurance for their grandchildren is “wishing bad things” or that it is “jinxing them.” When in reality, purchasing a life insurance policy is protecting them almost from birth. Did you know? You can purchase a life insurance policy as early as 14 days old. Another positive reason you should consider is that it is inexpensive. So the next time you are trying to decide what to gift your newborn grandchild, consider a life insurance policy.

2 – “401k’s are a waste of time,” according to 25-year-olds.

Some young working professionals might say that 401k’s aren’t a smart investment since they are changing employers fairly often and perhaps want to one day be an entrepreneur. I would tell them that they should consider a life insurance policy. Did you know that you can structure a life insurance policy so you can contribute to your retirement goals outside of committing to an employer-based 401k? In general, the younger and healthier you are when you begin will determine what it will take to get to that retirement goal. There is no right answer to how much you want to accumulate, either. It really depends on whether you want it to be just a part of your retirement plan, or all of it. And what is budget-friendly, too.

3 – “I’ve got life insurance through my work, I think that’s enough.”

Sure, it’s better than most individuals out there. However, when you purchase a life insurance policy on your own… You own it, so when and if you change jobs it doesn’t disappear on you. You are paying for it from your personal account; with an employer life insurance policy, it may be 100% paid for by the employer, and it’s enough to cover final expenses if you pass away while you’re an employee. When you leave that job, it doesn’t automatically go with you.

4 – “I’m leaving my job, I can’t take my company life insurance with me.”

Hold on…Yes, you can! You’ve got some options. Did you know that you can convert it to an individual policy, and it may be worthwhile to do so if your health has changed over time. Remember, you’re never as young or as healthy as you are right now, and there are some folks who may not be able to buy life insurance of their own. Talking to your independent insurance broker about this can help you decide what’s best for you.

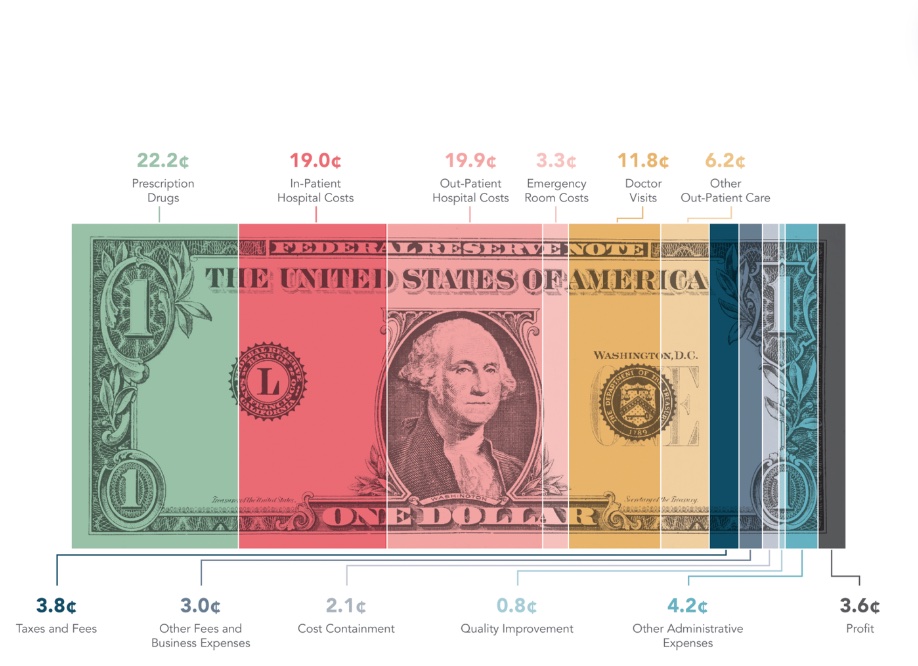

5 – “Life insurance is expensive.”

The short answer is… it depends! There are many reasons and purposes for life insurance, so different types of policies have different costs depending on what you want them to do for you. Again, talking with your independent broker will help you understand the best course of action for you. Your needs could be different at different stages of life, too, so it’s a conversation worth having with your broker by doing annual policy reviews.

Conclusion

Don’t believe everything you hear or see online. Talk to your broker and see what works best for you and your family. As an experienced HealthMarkets licensed insurance agent, I can help you narrow your options and determine what type of life policy would most fit your needs. I would be happy to have a conversation with you, contact me today!