Whether or not you provide health insurance to your employees will directly influence

the turnover rate and retention within the company, and that’s a fact. Attracting and retaining a

talented workforce should be vital to you if the growth and profitability of your business is

important. And, an employer-provided health insurance plan is essentially a prerequisite for

many college-educated potential full-time hires. Evidence can be found no further than a recent

study by America’s Health Insurance Plans (AHIP) in which over half of the employee

participants reported that satisfaction with their health plan plays a crucial role in their decision-making as to whether they should stick with their current company or leave, as well as whether

to accept a role in the first place. It’s clear that offering an employee health insurance package is

beneficial to the growth of your business in the long run, but providing it to your employees,

especially if you’re a small business, doesn’t always seem affordable. Fortunately, we know a

few strategies to reduce healthcare costs that can help you provide health insurance to your

employees without breaking the bank.

Add To Subtract (Options/High-deductible Plans + HSA=Reduced Healthcare Costs)

At least, some percentage of that bright shiny, talented workforce will be millennials and recent

generation Z grads. Younger, healthier employees are often happy with high-deductible plans as

long as they can combine them with a Health Savings Account (HSA). Adding a high deductible

plan, plus an HSA, to the menu allows these employees to pay a lower premium but still put

money aside for unforeseen circumstances. Some employers find their costs decrease to less than

what they were paying for traditional coverage even if they contribute to worker HSA accounts.

Facilitate Preventative Healthcare and Education

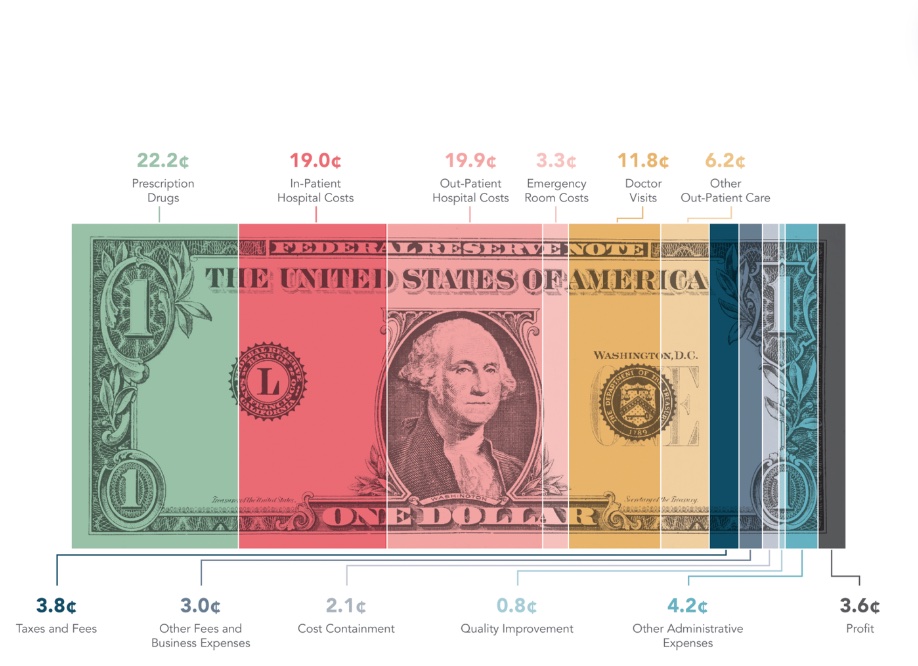

The biggest barrier to an employee when it comes to healthcare is not understanding how to use

it. That’s not to condescend anyone. We just don’t know what we don’t know. For instance,

employees might benefit from some information about where to find cost-saving deals on

prescriptions or local options that can help avoid a costly ER visit when possible inappropriate,

such as an Urgent Care or Minute Clinic. It’s also important to offer ways for your employees to

stay healthy, including encouraging preventative care and offering on-site fitness facilities and

nutritional food choices and/or a discounted gym membership partnership. This is beneficial to an

employer on every level from financial to humanitarian.

Keep an In-House or AI Expert

Whether you offer a healthcare concierge in the form of a healthcare agent, someone in HR, or

an online software program, make sure your employees have an accessible resource they can

utilize in case they have questions and the time to do research before an answer is required. The

key benefit here is that the employees will gain an intermediary— someone they can connect

with to help them decipher complicated healthcare decisions. Making smarter, more informed

decisions about procedures and the costs involved can reduce spending all the way around.

These suggestions are just the tip of the insurance iceberg when considering all of the

potential options and strategies for reducing healthcare spending. In fact, one key benefit of

partnering with an insurance agent is having someone to sift through the possibilities and design

a customized plan, fleshed out and refined with and for you. Suzanne Smaltz, a licensed agent

for HealthMarkets, offers you value in this process, helping you consider creative ways to cut

costs while still providing quality healthcare options to your employees. If you’re interested in

exploring your options for reducing healthcare spending on existing plans or implementing a

new cost-effective healthcare plan tailored to your business, don’t hesitate to visit her website or

contact her at (330) 285-3600. She looks forward to working with you!