Health Insurance

What is Health Insurance

Health insurance is a financial mechanism that provides coverage for medical expenses incurred by individuals. It typically involves monthly premiums paid by policyholders in exchange for benefits that offset the cost of healthcare services, including doctor visits, prescription medications, and hospital stays. Health insurance aims to mitigate the financial burden of unexpected medical expenses and promote access to necessary healthcare services.

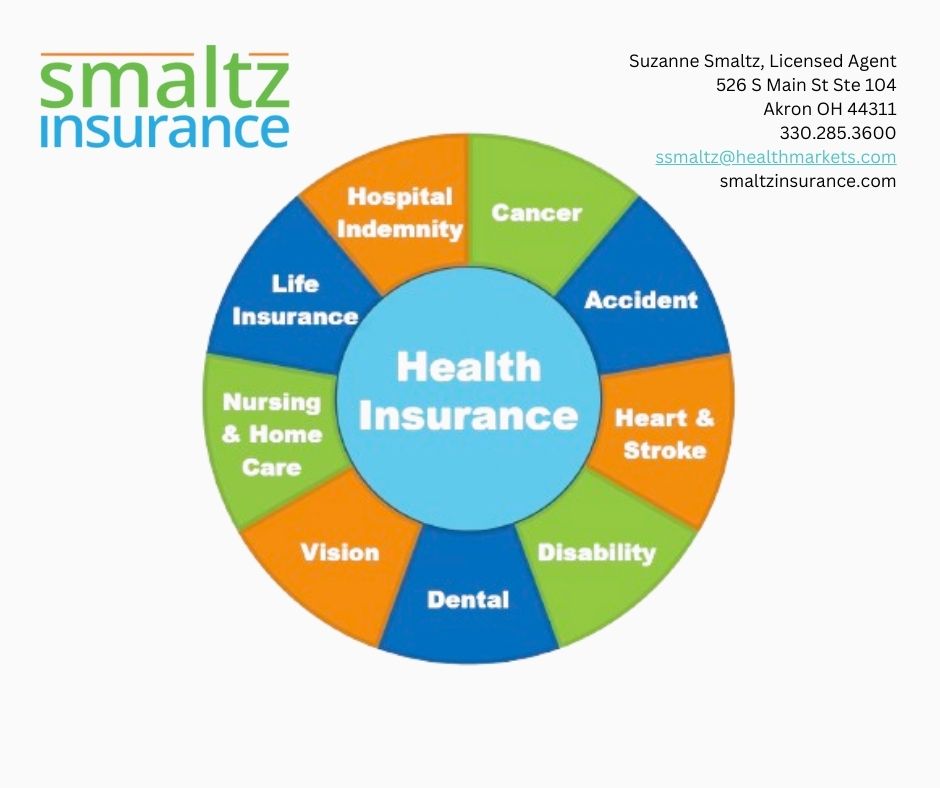

Types of Health Insurance

Health Maintenance Organization (HMO): HMO plans typically require members to select a primary care physician (PCP) and obtain referrals from the PCP to see specialists. They often have lower premiums and out-of-pocket costs but offer a more limited network of healthcare providers.

Preferred Provider Organization (PPO): PPO plans offer more flexibility in choosing healthcare providers without needing referrals. They have a broader network of doctors and hospitals but may come with higher premiums and out-of-pocket costs, especially for out-of-network services.

Exclusive Provider Organization (EPO): EPO plans combine features of HMO and PPO plans. Like an HMO, they usually require members to select a primary care physician, but like a PPO, they don’t typically require referrals to see specialists. However, coverage is typically limited to in-network providers only.

Point of Service (POS): POS plans also blend features of HMO and PPO plans. Members choose a primary care physician and need referrals for specialist care, but they can also see out-of-network providers, albeit at a higher cost.

High-Deductible Health Plan (HDHP): HDHPs have higher deductibles than traditional plans but often lower premiums. They’re often paired with Health Savings Accounts (HSAs), allowing individuals to save pre-tax dollars to pay for qualified medical expenses.

Catastrophic Health Insurance: Catastrophic plans are designed for young, healthy individuals and offer minimal coverage for essential healthcare services until a high deductible is met. They provide financial protection in case of a major medical emergency.

Short-Term Health Insurance: Short-term plans offer temporary coverage for individuals in transition, such as those between jobs. They typically have limited benefits and shorter coverage periods compared to traditional plans.

Each type of health insurance plan has its own advantages and disadvantages, and the most suitable option depends on individual healthcare needs, budget, and preferences.